How Self Employed Professionals in Belgium Can Easily Adapt to the New E-Invoicing Rules

From 2026, sending and receiving B2B invoices in Belgium will require compliance with Peppol standards. This new regulation affects all companies, including self-employed professionals, freelancers, and SMEs. Many freelancers and self-employed professionals in Belgium currently create invoices using Word or Excel and send them as PDFs. With Melasoft Portal, you can continue your invoicing practices while staying compliant without major additional costs.

Freelancer e-invoicing solutions in Belgium

If you’re searching for freelancer e-invoicing solutions in Belgium or wondering how to comply with Peppol as a self-employed professional, this guide will help you stay ahead of the changes.

Struggling with E-Invoicing Complexity?

Here’s What You Need to Know

- Complexity: New invoicing standards can feel overwhelming and complicated to implement.

- Cost Concerns: Switching to full-fledged e-invoicing systems may seem expensive.

- Time-Consuming: Manual data entry and invoice creation take valuable time away from business operations.

- Compliance Risks: Failing to meet e-invoicing requirements can result in penalties or delays in payments.

Many freelancers and SMEs in Belgium are looking for simple, cost-effective ways to transition to e-invoicing without disrupting their current workflow.

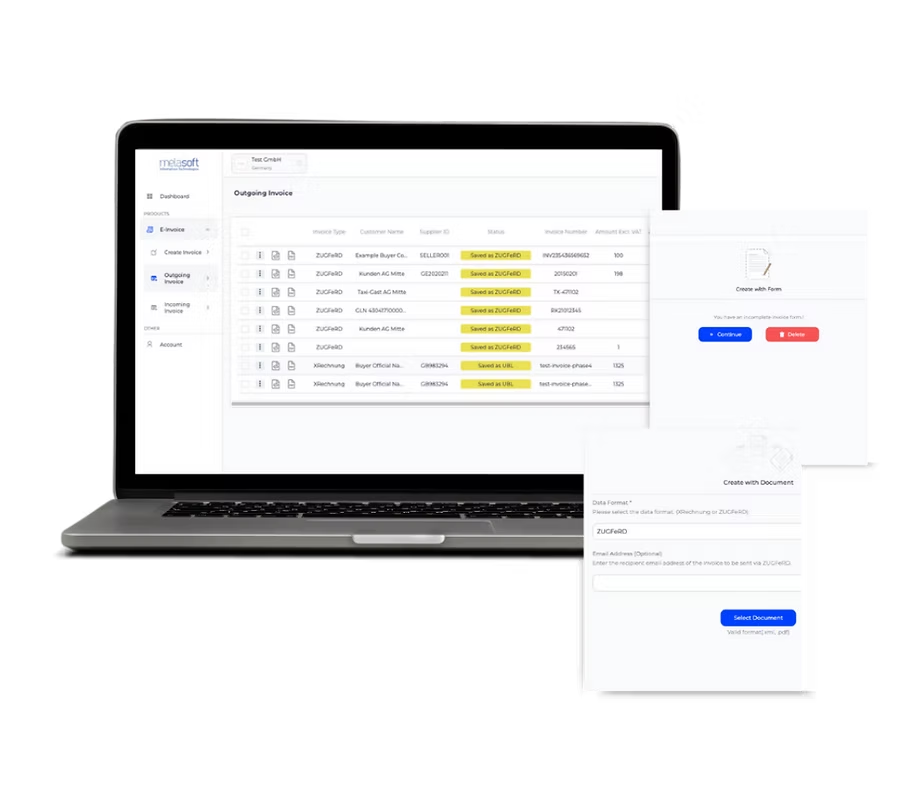

A Simple Solution for E-Invoicing: Melasoft Portal

Melasoft Portal is designed with freelancers, SMEs, and self-employed professionals in Belgium in mind. Our solution allows you to create, send, and receive e-invoices without disrupting your workflow or adding significant costs.

Key Features That Address Your Needs

- Automate Data Entry with OCR Technology No more manual input. Our OCR feature extracts data from invoices and populates fields automatically.

- Send and Receive E-Invoices Instantly Use our EASY e-Invoice system to comply with Peppol standards effortlessly.

- Excel Integration for Bulk Uploads Continue using Excel for bulk uploads and manage large invoice batches seamlessly.

- Email Parser for Streamlined Workflows Automatically extract invoices from emails and integrate them into your accounting system.

- Global Compliance with Peppol Network Ensure international and local compliance, reducing risks and expanding business opportunities.

MelasoftPortal

Melasoft Portal Covers All Your Needs in Belgium’s E-Invoicing Transition

- Cost-Effective: No need to overhaul your invoicing system. Continue using familiar tools like Excel and Word.

- User-Friendly: Simple, intuitive platform tailored for non-technical users.

- Future-Proof: Stay ahead of regulations and avoid last-minute compliance issues.

- Comprehensive for Freelancers and SMEs: Melasoft Portal addresses the pain points faced by self-employed professionals, freelancers, and SMEs in Belgium during the e-invoicing transition. It simplifies the process, reduces costs, and ensures compliance without technical complexity.

Whether you are searching for B2B e-invoicing solutions for SMEs in Belgium or need freelancer-friendly invoicing software, Melasoft Portal covers all your invoicing needs.

Conclusion: Don’t Wait Until 2026

By adopting Melasoft Portal now, you can ensure a smooth transition to the new e-invoicing regulations in Belgium. Avoid the rush, minimize costs, and keep your invoicing process running without interruption.

Ready to Simplify E-Invoicing?

Try Efactuurhub Portal today and get your first 20 invoices for free.

Sign Up Now

Get your first 20 invoices free with Melasoft Portal!